Gross Premium Written, or GPW, in the Nigerian insurance sector increased by 10.24% from N508 billion in 2020 to N560 billion in 2021.

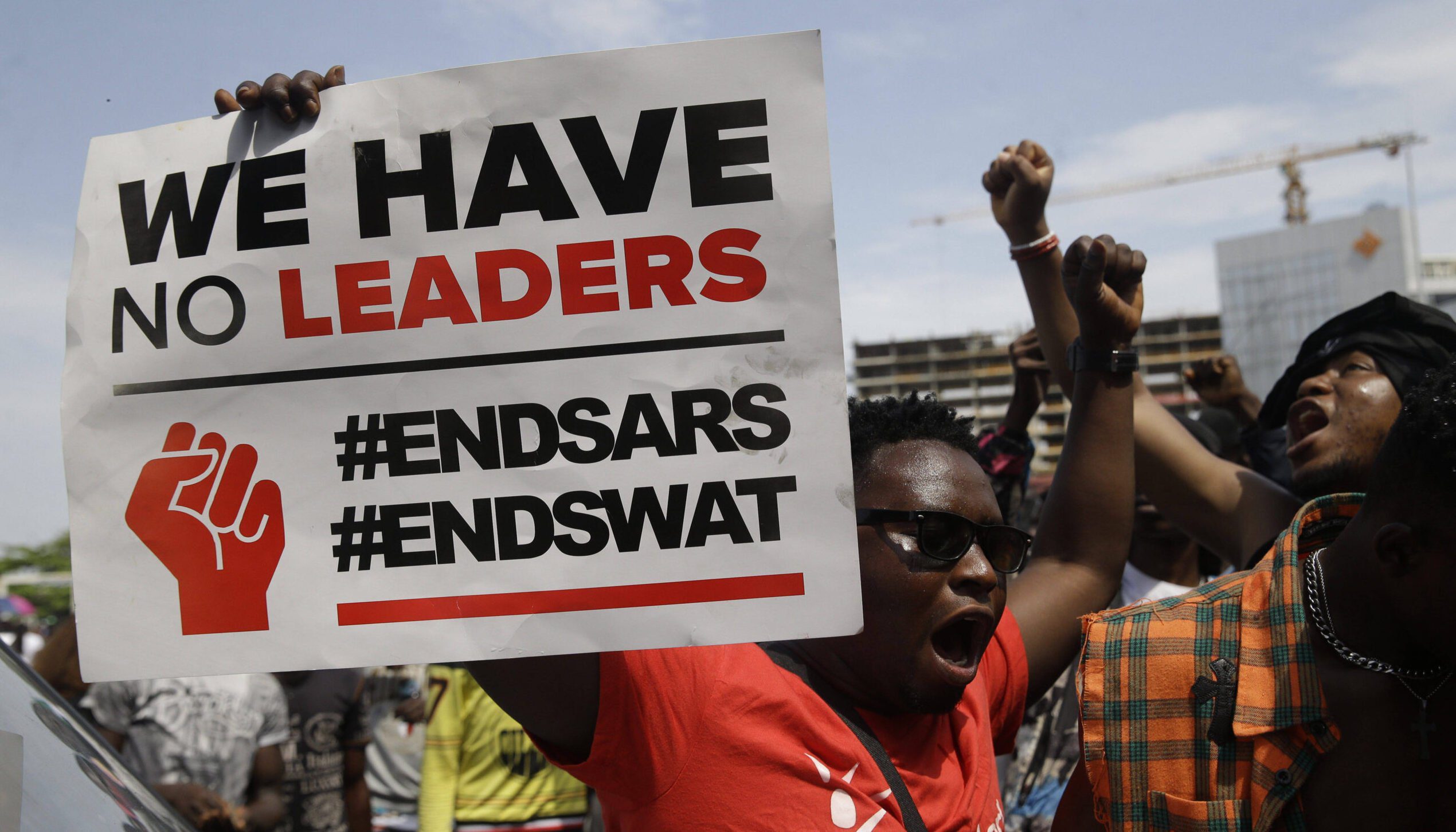

The industry has already paid out N11.1 billion in claims to insured parties who sustained various damages during the EndSARS rallies.

Mr. Ganiyu Musa, the chairman of the Nigeria Insurers Association, NIA, said this during the association’s annual general meeting in Lagos and stated that the sector accomplished this milestone despite the many difficulties it faced during the reviewed period.

He stated: “One of the main objects of NIA is promotion of ethical conduct among members and this includes payment of all genuine claims. Pursuant to this, the association took very keen interest in developments around the #EndSars protests in October 2020, especially as they relate to payment of claims for insured losses. I am happy to report that as at December 2021, our member companies have paid over N11.1billion claims to insured. The payments cut across several classes of insurance business such as fire/burnt site, vandalization, burglary attack, as well as loss of cash.

“The Nigerian insurance industry was not insulated from developments in the general economic space and had its fair share of the challenges facing the larger financial market during the year under review. With epileptic power supply and an astronomic rise in the energy cost against the background of failing infrastructure, insurance companies had to contend with increasing cost of operations. These and many other factors including the multiplicity of taxes, contributed to affect the bottom line of insurance companies.

“Notwithstanding these challenges, the insurance industry continues to perform its statutory role of financial intermediation and business restoration. The volume of business written by member companies grew from N508 billion in 2020 to about N560 billion in 2021, representing an increase of 10 percent.”